Diagnosis, Why?

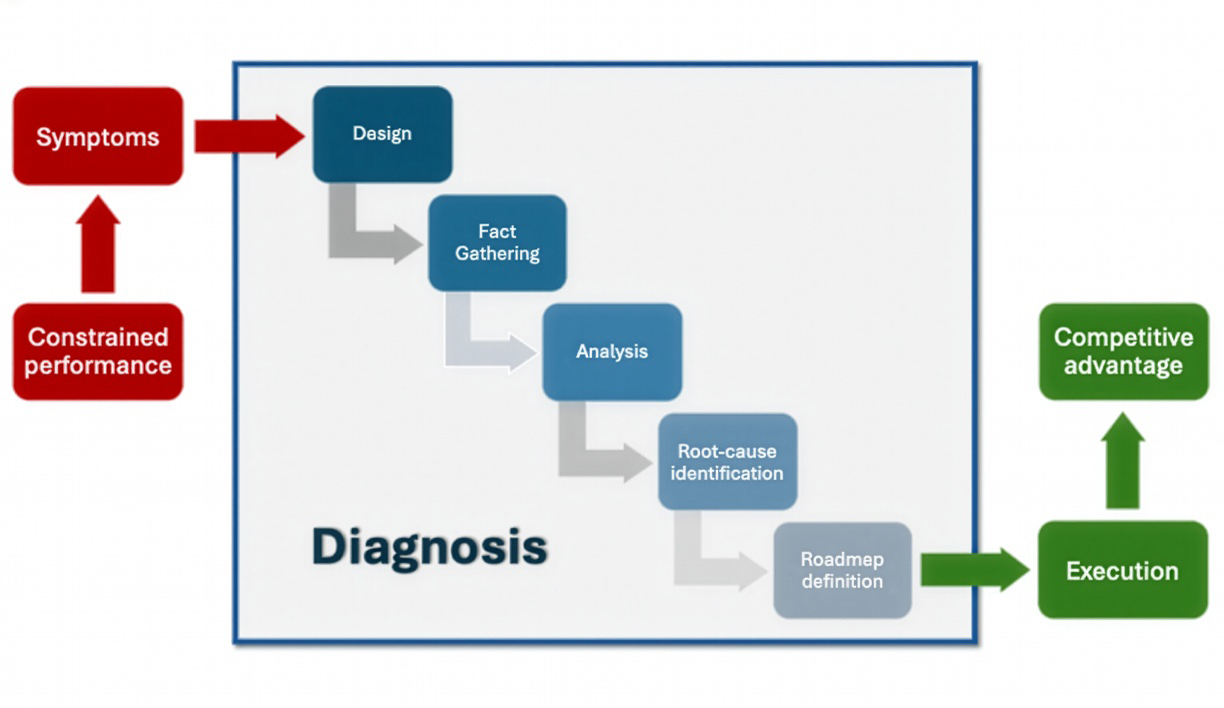

Insurers operate in an environment of sustained margin pressure, rising operational complexity, regulatory intensity, and rapidly shifting customer expectations. In this context, performance is not driven by isolated initiatives, but by the disciplined alignment of the full system: strategy, organization, processes, technology, governance, and capabilities.

As human, any organization, business line, or process operates as an integrated system. A weakness in any single component—governance, underwriting or claims processes, distribution, IT platforms, performance management, or talent—impacts the overall performance. Too often, organizations focus on correcting visible symptoms (delays, cost overruns, declining NPS) rather than addressing the structural root causes, limiting impact and sustainability.

The ambition of the diagnosis is to provide executives and senior managers with:

- A clear, fact-based, identification of root causes constraining performance and strategy execution,

- A prioritized, pragmatic, and results-oriented roadmap.

This approach enables targeted transformation, delivering measurable improvements and sustainable competitive advantage.

Diagnosis, What?

The diagnosis follows a rigorous, and decision-oriented approach, structured around four core steps:

- Structured fact gathering

- Design of diagnosis tools tailored to client and insurance-specific challenges (questionnaires, interview guides, document reviews)

- Collection of qualitative and quantitative inputs from senior leaders, key business owners, and critical support functions

- Analysis and perspective

- Consolidation of findings and assessment of performance gaps

- Implicit benchmarking of practices and maturity levels

- Weaknesses and root-cause identification

- Systemic assessment of the organization

- Identification of breakpoints impacting operational, financial, and customer performance

- Actionable roadmap definition

- Translation of insights into concrete initiatives

- Prioritization based on business impact, required resources, and speed to impact

Diagnosis, How?

Organization, roles and responsibilities are:

- Diagnosis design

- ST2I designs the diagnosis questionnaire and tools, incorporating client and insurance industry specifics

- Alignment with the executive/business sponsor

- ST2I finalizes questionnaire and tools based on executive/business sponsor guidance and decisions

- Fact gathering

- Business leaders and project teams conduct information gathering across organization

- ST2I supports the process to ensure rigor, consistency, and objectivity

- ST2I runs interviews

- Workshop preparation

- ST2I runs in-depth pre-analysis of inputs

- ST2I Pre-identifies structural weaknesses, root causes, and value-creation opportunities

- ST2I designs the decision-oriented workshop

- Alignment with the executive/business sponsor

- ST2I finalizes the workshop design based on executive/sponsor guidance and decisions

- Workshop (co-facilitated by executive/business sponsor and ST2I)

- Day 1 – Facts and alignment: Presentation of key findings and alignment on diagnosis

- Day 2 – Performance levers: Identification of improvement opportunities and priority levers

- Day 3 – Decisions and prioritization: Selection and prioritization of actions based on business impact, resource requirements, and timelines

- Roadmap finalization

- ST2I and business sponsor develop the detailed roadmap

- Executive reviews the roadmap with ST2I and business sponsor

- ST2I Finalizes the roadmap based on executive guidance and decisions

Engagement effort

A diagnosis engagement typically starts at 10 person-days for ST2I, adjusted based on scope, organizational complexity, and strategic ambition.

No responses yet